The Crypto industry has grown exponentially over the past few years reaching trillions of dollars in revenue. But one thing that still holds back crypto investors is the complexity around crypto taxes and their legal compliances.

You can keep track of your crypto investments manually but there’s always a chance of missing out on taxable transactions or overpaying your taxes.

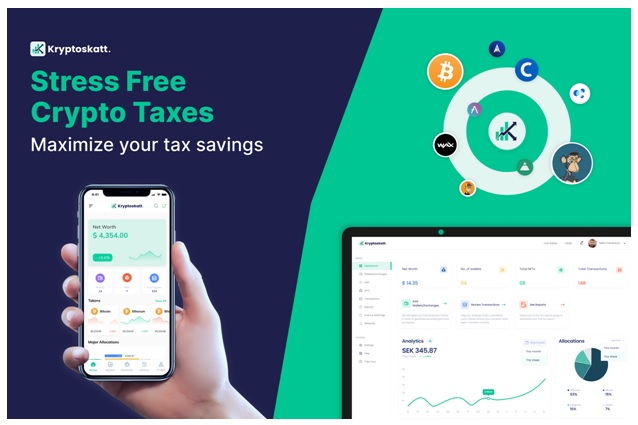

But the good news is – now, you can automatically calculate your crypto taxes in just a few minutes using this new crypto tax software – Kryptoskatt. The app keeps track of all your crypto transactions, prevents any calculation errors, and ensures you save the maximum on your taxes.

- Advertisement -

How Kryptoskatt Can Simplify Your Crypto Taxes

Kryptoskatt allows you to automatically import your transaction data into the platform and generate tax reports, ensuring accuracy and legal compliance. The platform supports the maximum number of integrations – including 200+ exchanges and wallets, 50+ blockchains, and also DeFi and NFTs – making it easy to manage all of your crypto investment portfolios in one place.

Kryptoskatt supports multiple currency and cost basis methods to provide an accurate calculation for your crypto taxes based on your country’s laws. The software automatically detects any transfers between your wallets and their tax implications so you don’t have to keep a track of them manually. There are also inbuilt mechanisms for error-handling and tax-saving strategies ( e.g. tax-loss harvesting) that can help you save thousands in your taxes.

Calculate Cryptocurrency taxes with Kryptoskatt

Here’s how you can calculate crypto taxes with Kryptoskatt in 5 easy steps:

- Get started by Signing Up on the platform. You can directly sign up using your Google or Apple account.

- Add your wallets to import your transaction history. To do this, you need to choose your wallet, add the wallet name and its public address. Click on “Import Transactions” to import all transactions or choose from a specific date range.

- Import your transactions directly using API keys or upload CSV files. You can auto-import your transactions or add them manually.

- Choose your currency and cost-basis method from the account settings. This helps in accurate tax calculations and ensures the reports are compliant with your country’s laws.

- Once done, you are now ready to calculate your taxes. Check for your capital gains and losses in the dashboard. You can also leverage tax-loss harvesting opportunities to save taxes.

- Check for any errors or warnings and fix the issue accordingly. Once done, you can generate and download your tax reports.

The best part is that the platform takes the security of its users seriously. It never asks for your private keys and only reads your transaction history shared by you to calculate your crypto taxes. This ensures your funds are always safe and no third party gets access to it.

Kryptoskatt is also available on Playstore or Appstore so you can simply download their mobile app and sort out your crypto taxes in just a few clicks.

To know all their latest updates, follow Kryptoskatt on Twitter, and Linkedin. If you want to start using the app, Sign Up Now and explore its exclusive features for free.